Secure Online Banking Transactions with Identity-Based Authentication

In today’s digital-first financial landscape, customers expect their banks to deliver robust security, privacy, and trust. To meet these expectations, financial institutions implement advanced security measures that are both user-friendly and highly effective. These controls help protect sensitive data, prevent fraud, and ensure compliance with financial regulations.

IdenTrust digital certificates help financial institutions enable secure, identity-based authentication and encrypted communications across online banking platforms.

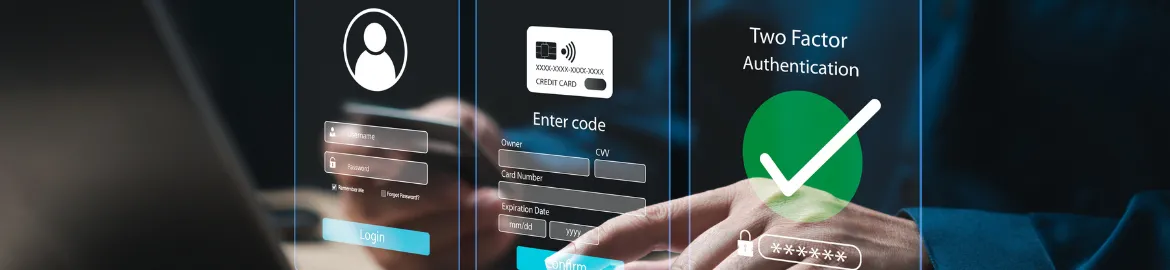

Financial institutions often deploy a combination of identity-based solutions to secure digital transactions, including:

- Replacing traditional usernames and passwords with strong, two-factor authentication tied to verified digital identities.

- Using mobile-based push authentication, allowing customers to approve access requests and transactions securely from their devices.

- Implementing digital certificates to encrypt communications and validate user identities across platforms.

What is Two-Factor Authentication? (2FA)

2FA replaces passwords with identity-based authentication, combining a PIN with a trusted device for secure login.

What is Out-of-Band Authentication?

Verifying transactions via a separate channel, like mobile push, adds an extra layer of security for verified transactions.